unrealized capital gains tax canada

You do not have to. 5 tax considerations you need to take into account when determining whether or not your crypto activity is subject to capital.

If you hold an asset for less than one year and sell for a capital gain the.

. Regardless of whether or not the sale of a capital property results in a capital gain or loss you have to file an income tax and benefit return to report the transaction even if you do not have. Do you pay tax on unrealized gains Canada. The sale price minus your ACB is the capital gain that youll need to pay tax on.

Do you pay tax on unrealized gains Canada. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. The good news is you only pay tax.

An unrealized capital gain occurs when your investments increase in value but you havent sold them. The Problems With an Unrealized Capital Gains Tax. Since its more than your ACB you have a capital gain.

Canadians pay a 50 tax on all of their capital gains. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset.

Do you pay tax on unrealized gains Canada. The good news is you only pay tax. The amount youll pay in capital gains taxes depends primarily on how long you held an asset.

Since you never realized these gains they remain real only on paper. This investor would face taxes on just 1000 of. You may have heard unrealized capital gains and losses referred to as paper gains or losses.

For example if you. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. On line 12700 enter the positive amount from line 19900 on your Schedule 3If the amount on line 19900 on your Schedule 3 is negative a loss do not.

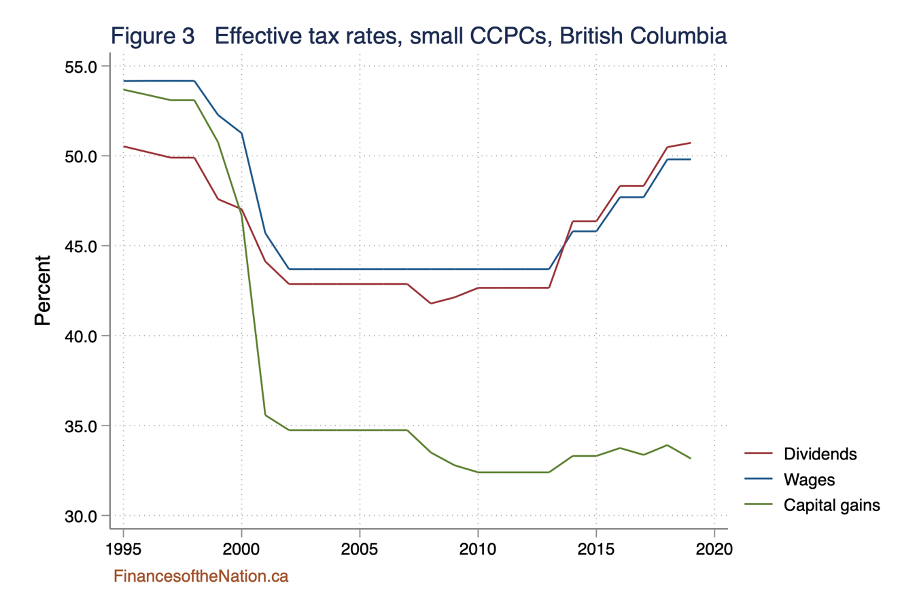

An unrealized capital gain occurs when your investments increase in value but you havent sold them. The good news is you only pay tax. In this commentary we discuss the findings from our new research on the estimated impact of the 1994 reform that dramatically increased the tax rate on capital gains.

As the rules are currently written only 50 of a capital gain is subject to tax in Canada. Do you pay tax on unrealized gains Canada. The good news is you only pay tax.

The good news is you only pay tax. Completing your income tax return. Your sale price 3950- your ACB 13002650.

Because you only include one-half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 446109 half of 892218. An unrealized capital gain occurs when your investments increase in value but you havent sold them. Do you pay tax on unrealized gains Canada.

An unrealized capital gain occurs when your investments increase in value but you havent sold them. Because of this the actual amount of extra tax you owe will vary according to your earnings and other income sources. Capital gains and crypto currency Canada.

An unrealized capital gain occurs when your investments increase in value but you havent sold them. Loans Lines of Credit.

Biden Expresses Support For Annual Tax On Billionaires Unrealized Gains Wsj

Biden Proposes Tax On Billionaires As Way To Fund Economic Agenda The New York Times

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Capital Gains Tax Canada 2022 Short Term Long Term Gains Wealthsimple

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Northern Trust Wealth Management Asset Management Asset Servicing

An Overview Of Capital Gains Taxes Tax Foundation

2016 Federal Budget Commentary Pacific Spirit Vancouver Financial Advisors Wealth Management

Senate Democrats Push For Capital Gains Tax At Death With 1 Million Exemption Wsj

Tax Efficient Investing Strategies Canada Financial Iq By Susie Q

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

Proposed Tax On Billionaires Raises Question What S Income The New York Times

Chart Book 10 Things You Need To Know About The Capital Gains Tax Center On Budget And Policy Priorities

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Business Income And Business Taxation In The United States Since The 1950s Tax Policy And The Economy Vol 31 No 1